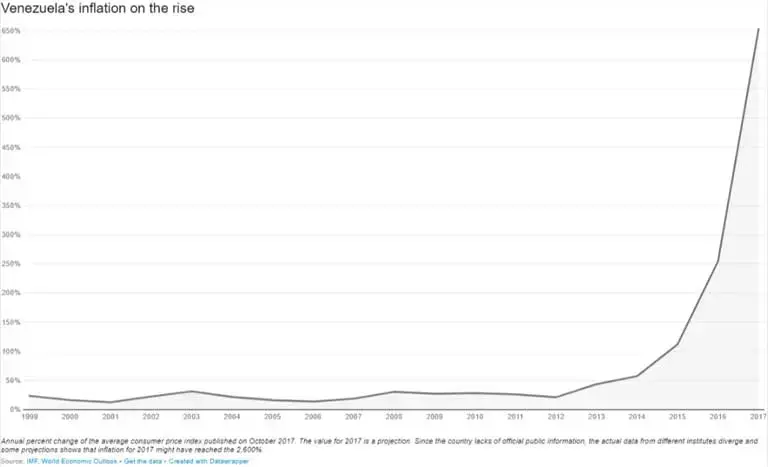

- With Venezuela’s hyperinflation rate soaring to an estimated 2,700 percent in 2017, corruption and looting rife, and food and medicine in short supply nationwide, President Nicolás Maduro is desperate to find solutions to the country’s deepening economic crisis.

- Many of the president’s solutions, including the Arco Minero and the Petro cryptocurrency, could end up selling off Venezuela’s mineral wealth while devastating indigenous territories and the environment, including the Venezuelan Amazon.

- The Arco Minero, announced by Maduro in 2016, would open 112,000 square kilometers, more than 12 percent of the country, to mining. And while Maduro has invited transnational companies to do the work, most mining that is currently being done is controlled by corrupt elements of the military and organized armed gangs.

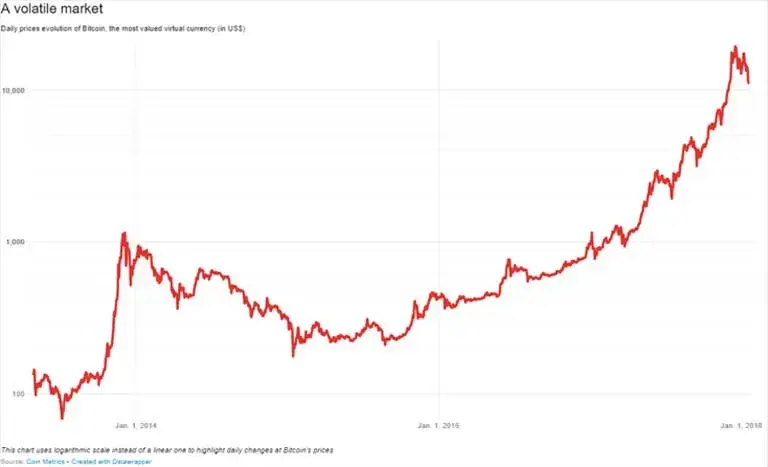

- In December, Maduro announced the Petro cryptocurrency, another scheme likely meant to help ease Venezuela’s debt. The new virtual currency would either be backed by the country’s untapped oil wealth or mineral wealth, including gold, coltan and diamonds. The fear is that none of these policies will prevent Venezuela from becoming a failed state.

This story is the third in a series of Mongabay articles about Venezuela’s Arco Minero, produced in partnership with InfoAmazonia which has launched an in-depth multimedia platform called Digging into the Mining Arc, exclusively highlighting Venezuela’s mining boom. The three Mongabay stories by Bram Ebus can be found here, here and here. A fourth story, by Mongabay Editor Glenn Scherer, summarizing the series, can be found here.

President Nicolás Maduro, an enigmatic smile blossoming beneath his tradmark mustache, proudly displays a gold ingot to the Venezuelan press. The metal is reportedly part of a batch dug and processed inside the Arco Minero, a vast area covering 112,000 square kilometers (43,243 square miles), south of the Orinoco River and in the Venezuelan Amazon.

Meanwhile, in the middle of the Arco Minero, a minerals expert who asks not to be named out of concern for his safety, flashes an even bigger smile as he casts doubt on the authenticity of that ingot and of the first batch of Arco Minero gold.

Maduro “made up some propaganda with almost 1,000 kilos [2,200 pounds] of gold. Somebody who does not know [better] will think ‘Whooo! 1,000 kilos of gold!’” the unnamed source laughs, noting that the ingots from that purported first shipment are of different sizes and purity, and more importantly, are completely without certification, meaning that there is no way to guarantee where or when the gold was mined.

“From whom are they buying?” he asks. “Illegal mining and the mafias of illegal mining! Here [in the Arco Minero] they are called pranes.”

This anonymous mineral expert is not alone in his view. Many analysts dispute the Venezuelan government’s claims about the Arco Minero.

The so-called Mining Arc, a crescent sweeping east to west across Bolívar state, was opened to mining in 2016 by Maduro and covers 12.2 percent of the nation’s territory. The president views its potential wealth as his country’s salvation from its horrific economic crisis, and even proposed in December a new cryptocurrency partly based on the region’s hidden ores. Government authorities have at times optimistically boasted that the region holds 7,000 tons of gold (worth roughtly $200 billion); plus $100 billion in coltan, a metallic ore ubiquitous in electronic devices; and 3 billion carats in diamonds.

However, the extent of the deposits within the Mining Arc, a wild and remote region of inaccessable plateaus and rainforests, is truly unknown. What is certain is that the four designated mining areas within Bolívar state are home to 198 indigenous communities, plus numerous protected ecosystems including Canaima National Park, a UNESCO World Heritage Site; Imataca Forest Reserve; La Paragua and El Caura reserves; Cerro Guanay Natural Monument; and the Caroní River watershed. All are under threat from the Arco Minero.

Ultimately, the government hopes to attract foreign investors and transnational mining companies to the Mining Arc, but financiers and mining firms may think twice before risking entry into the region. Today, the Arco Minero is a violent, largely lawless territory, where corrupt military leaders, armed gangs, large- and small-scale illegal miners, and guerrillas all compete in a free-for-all for mineral wealth.

Macroeconomic Bluff?

Venezuela became an oil-producing country in 1914 and over ensuing decades rapidly evolved from a poor developing nation to a petro powerhouse, dominated by transnational oil firms and a political elite enriched by one of the world’s largest reserves of the black gold.

The oil has never stopped flowing, and in recent years it reportedly made up about 95 percent of the country’s export earnings; combined with natural gas, it accounted for 25 percent of the nation’s gross domestic product. The big oil earnings sound positive until one considers that much of the revenue is used to pay off foreign debt, mainly to China. When the price of oil plummeted in 2014, the country descended into economic ruin.

At the moment, Venezuela´s oil sector isn’t even able to pay its own employees, and the nation has failed to operate its oil infrastructure efficiently, with the environment suffering mightily as a result. Consequently, Maduro´s Mining Arc plans have raised many eyebrows among international analysts, some of whom say the plan is largely a pipe dream — a desperate, unsustainable extension of Venezuela’s resource extraction-based economy.

It is a “schizophrenic plan” that views mining as the new oil, according to Rafael Uzcátegui, the general coordinator of Provea, a Venezuelan human rights NGO. He describes Venezuela as a rentier state – a nation deriving the lion’s share of its national revenues from the sale of indigenous natural resources to transnational corporations and other countries.

Uzcátegui says the government has in the past considered abandoning the rentier model because of Venezuela’s negative economic experiences with its overdependence on oil. However, both of its most recent socialist presidents, Hugo Chávez, who ruled from 1999 to 2013, and Nicolás Maduro have hyped plans to base Venezuela’s hyperinflation-ridden economy (likely exceeding 2,700 percent for 2017) on the nation’s finite resources, seriously deepening reliance on the rentier model.

Complicating matters, the relationship between Venezuela and the transnational extraction industry has been a troubled one. Many foreign corporations, including ExxonMobil and Cargill, saw their Venezulan properties expropriated under Chávez, who openly dreamed of a strong state-led extractives sector.

Today, Maduro claims that “150 companies from 35” nations are very interested in investing in the Arco Minero and Venezuela’s mining bonanza. However, few firms have followed through on this interest, possibly out of fear of future nationalization, and almost certainly due to the ongoing political instability in the country.

Some experts say that by boasting about Venezuela’s mineral wealth and the interest of foreign mining companies, Maduro is engaging in a macroeconomic bluff. “Venezuela has never been a big producer of gold,” says Alexander Luzardo, a former senator with a doctorate in political and environmental law, who helped draft environmental standards included in Venezuela’s 1999 constitution, when Chávez rose to power.

“There is no big gold reserve!” Luzardo says, then laughs: “The elites of the country love to say this,” but it is false.

Likewise, geologist Noel Mariño, an expert on coltan, doubts whether Venezuela possesses the vast mineral deposits that its government claims. Nobody can be sure, he asserts, “until pertinent geological evaluations that involve a series of disciplines including geology, geochemistry, geophysics and more, are carried out.”

Luzardo and Mariño suspect that hoped-for international economic speculation is the reason behind the vastly inflated claims of mineral wealth made by the Venezuelan government, state company Minerven, and by some foreign companies, including Empresa Mixta Minera Ecosocialista Parguaza (a joint venture) and the Congolese Afridiam. A company’s value increases if it possesses the legal paperwork for a supposedly valuable mining concession, and then offers that concession for sale. Also, if international markets believe there is a lot of gold and other valuable ores in Venezuela, then the nation’s terrible credit rating could improve, allowing it to receive more big loans.

An interactive map zoomed in on the the Brisas-Cristinas deposit claimed by Gold Reserve Inc.in Bolívar state. Zoom out to see the complete Mining Arc. Map by InfoAmazonia“There is a problem of the selling and reselling of mining concessions on the international stock exchanges,” Luzardo says. “That’s a big business.”

Gold Reserve Speculative Shell Game?

To elucidate how economic speculation may be operating in Venezuela, the Brisas-Cristinas deposit in Bolívar state offers a good example.

Brisas-Cristinas is purported to be one of the largest undeveloped gold and copper deposits in the world and one of the most important mineral reserves in Venezuela. Gold Reserve Inc., a Canada-based company, originally acquired the concession in 1992 and claims to have invested $300 million in the site’s development, only to have its original authorization revoked by the Venezuelan government under Chávez in 2009.

Gold Reserve sought compensation for the loss through the World Bank’s International Centre for Settlement of Investment Disputes (ICSID). The ICSID ruled that Venezuela violated the Canada-Venezuela bilateral investment treaty and ordered Venezuela to pay a $1.03 billion settlement. After all this investment and litigation, Gold Reserve still hadn’t mined a single gram of gold in Venezuela.

In December 2016, Gold Reserve Inc. stated on its website that it had modified the settlement agreement with Venezuela, loosening payment terms and restructuring its claim. It appears the transnational firm will continue to operate the Brisas-Cristinas deposit in the Arco Minero through a 45 percent stake in a joint venture, named Siembra Minera, with the state-owned Venezuela Mining Corporation (CVM). Gold Reserve’s stake is held through a subsidiary, GR Mining, based in the tax haven of Barbados. The recent Paradise Papers revelations — a massive cache of secret financial documents released last year exposing offshore tax havens — show the new company was created on April 15, 2016, and that two of its directors are Alexander D. Belanger and Robert A. McGuineness, who are also officers of Gold Reserve, Inc.

James H. Coleman, the Gold Reserve chairman, lauded the joint venture on the firm’s website, saying “This is an important event not only for Gold Reserve, but for Venezuela as it confirms to the mining and investment communities that you can do business in Venezuela and that it is indeed open for international business.”

Siembra Minera claims to own an estimated 20 million ounces of unmined gold, which if true would certainly attract international investors. But, as with other claims in the Arco Minero, Siembra Minera’s claim cannot be substantiated because the numbers haven’t been formally verified or certified.

The setup has raised questions over whether Venezuela entered into the joint venture under pressure from Gold Reserve via the international arbitration court ruling. When Siembra Minera was formed, Gold Reserve saw its stock price nearly double on the Toronto Stock Exchange. The firm’s website trumpeted the terms of the new arrangement, possibly to assure wary potential investors: “Venezuela will indemnify Gold Reserve and affiliates against any future legal actions associated with the Brisas-Cristinas project.”

Venezuela is currently paying off the $1.03 billion settlement in installments. In total, including interest, the country now owes a staggering $150 billion to its many creditors.

Juan Carlos Sánchez, an expert with the UN’s Intergovernmental Panel on Climate Change, which won the 2007 Nobel Peace Prize, says this deal shows an absolute loss of control by the state of its own finances: “In this case, the government did not [use its] strength to defend the sovereignty of the country.”

As creditors line up to demand billions from an already economically shattered Venezuela, it remains uncertain whether Gold Reserve will ever be able to exploit the Brisas-Cristinas deposit. Currently, the mines in the region are overrun by armed gangs, pranes and sindicatos, possibly numbering some 30,000 or more illegal miners. These miners are fast transforming the Gold Reserve site into an environmentally devastated moonscape covered in mercury-tainted ore piles and waste lagoons.

Petro Cryptocurrency to The Rescue

Neither Venezuela’s oil nor its minerals have yet been able to pull the nation out of its precipitous economic tailspin. Making matters worse are economic sanctions imposed largely by the U.S. against some members of the nation’s political elite for alleged corruption and drug trafficking — financial limitations that are also causing problems for international investors.

In December, President Maduro proposed a new solution, unveiling the “Petro,” a supposedly revolutionary kind of cryptocurrency backed by the nation’s natural resources: oil, gas and precious metals. “The 21st century has arrived!” the president declared at a press conference. “Venezuela [has] positioned itself at the vanguard of the world. The first country that created a cryptocoin that is based on its country’s natural richness.”

The new virtual currency is meant to enable Venezuela to “advance in issues of monetary sovereignty, to make financial transactions and overcome the financial blockade,” Maduro said.

However, some see the Petro as just another rentier scheme, especially because Maduro offered no details as to how the new cryptocurrency might work, who will have access to trading it, and on what platforms. Opposition National Assembly lawmaker Angel Alvarado said the Petro “had no credibility,” and was nothing more than “Maduro being a clown.”

Economists speculate Maduro is looking to use the Petro to pay off some of Venezuela’s debt to foreign creditors. Environmentalists remain wary, saying the Petro could put Venezuela’s ecosystems and biodiversity on the line, as conserved forests and indigenous territories are exploited to rescue the freefalling economy.

Parliament, which Maduro last year sought to strip of its power, has declared the Petro illegal, saying the government is unjustly seeking to “mortgage” the country’s oil reserves. Over the coming weeks, 100 million Petros (backed by an equal amount of as yet unexploited barrels of oil) are expected to flow into world markets. However, much remains unclear about the soon-to-be-released cryptocoin. At first, for example, Maduro claimed the Petro would be backed by the nation’s gold, coltan and diamond reserves; but in recent communiqués the Venezuelan leader only speaks of oil.

Economic experts tell Mongabay they are perplexed by what is happening. “The promise by the [Maduro administration] to back the value of the Petro with commodity reserves is not really believable,” says Asrúbal Oliveros, an economist and director at the Venezuelan think tank Ecoanalítica. For the scheme to work, the government “would be obligated to exploit additional commodities to the ones they [already] export, with the objective to pay [for] the ones that they decide to convert into Petros.”

Both the Arco Minero and the Petro, these analysts say, are not only a step backward and a re-embrace of the rentier state, but strategies based on haste and speculation that will likely do little to combat Venezuela’s current economic upheaval. That’s because the national currency, the bolívar, continues to suffer hyperinflation despite Venezuela having the world’s biggest oil reserves. Most experts don’t think the Petro will make much difference.

Ultimately, these failed and failing economic policies matter most because they don’t address Venezuela’s real problems or change anything on the ground. Venezuela started 2018 with countrywide looting and food and medicine shortages. Armed roadblocks proliferate, while a corrupt military and gangs with guns continue to pillage the Arco Minero’s natural resources, its indigenous reserves and conserved areas. The possibility of Venezuela falling into total chaos and becoming a failed state is increasingly real.

Luzardo, the former senator, says that Maduro’s impractical schemes, including the Arco Minero and the Petro, indicate a “rushed search for financial income at the costs of the liquidation of [natural] resources, with consequences such as deforestation, soil destruction and mercury and cyanide contamination.”

The Venezuelan government did not respond to requests for comments on the articles presented in this Mongabay series.

This Mongabay series was produced in cooperation with a joint reporting project between InfoAmazonia and Correo del Caroni, made possible by a grant from the Pulitzer Center on Crisis Reporting. An InfoAmazonia multimedia platform called Digging into the Mining Arc features in-depth stories on the topic.